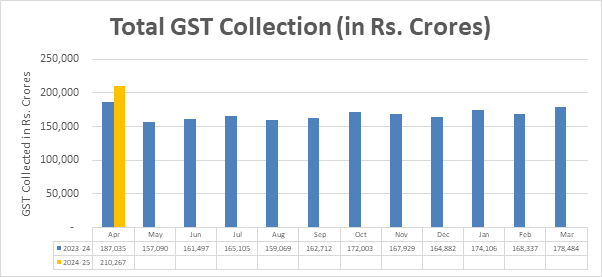

GST Collection April 2021 to April 2024

Analysis of GST Collection

Table of Content:

- GST Collections Tren

- Breakdown of April 2024 Collections

- Total GST Collections

Breakdown of April 2024 Collections:

- Central Goods and Services Tax (CGST): Rs. 43,846 crore;

- State Goods and Services Tax (SGST): Rs. 53,538 crore;

- Integrated Goods and Services Tax (IGST): Rs. 99,623 crore, including Rs. 37,826 crore collected on imported goods;

- Cess: Rs. 13,260 crore, including Rs. 1,008 crore collected on imported goods.

State-wise growth of GST Revenues during April, 2024

State/UT | Apr-23 | Apr-24 | Growth (%) |

Jammu and Kashmir | 803 | 789 | -2% |

Himachal Pradesh | 957 | 1,015 | 6% |

Punjab | 2,316 | 2,796 | 21% |

Chandigarh | 255 | 313 | 23% |

Uttarakhand | 2,148 | 2,239 | 4% |

Haryana | 10,035 | 12,168 | 21% |

Delhi | 6,320 | 7,772 | 23% |

Rajasthan | 4,785 | 5,558 | 16% |

Uttar Pradesh | 10,320 | 12,290 | 19% |

Bihar | 1,625 | 1,992 | 23% |

Sikkim | 426 | 403 | -5% |

Arunachal Pradesh | 238 | 200 | -16% |

Nagaland | 88 | 86 | -3% |

Manipur | 91 | 104 | 15% |

Mizoram | 71 | 108 | 52% |

Tripura | 133 | 161 | 20% |

Meghalaya | 239 | 234 | -2% |

Assam | 1,513 | 1,895 | 25% |

West Bengal | 6,447 | 7,293 | 13% |

Jharkhand | 3,701 | 3,829 | 3% |

Odisha | 5,036 | 5,902 | 17% |

Chhattisgarh | 3,508 | 4,001 | 14% |

Madhya Pradesh | 4,267 | 4,728 | 11% |

Gujarat | 11,721 | 13,301 | 13% |

Dadra and Nagar Haveli and Daman & Diu | 399 | 447 | 12% |

Maharashtra | 33,196 | 37,671 | 13% |

Karnataka | 14,593 | 15,978 | 9% |

Goa | 620 | 765 | 23% |

Lakshadweep | 3 | 1 | -57% |

Kerala | 3,010 | 3,272 | 9% |

Tamil Nadu | 11,559 | 12,210 | 6% |

Puducherry | 218 | 247 | 13% |

Andaman and Nicobar Islands | 92 | 65 | -30% |

Telangana | 5,622 | 6,236 | 11% |

Andhra Pradesh | 4,329 | 4,850 | 12% |

Ladakh | 68 | 70 | 3% |

Other Territory | 220 | 225 | 2% |

Center Jurisdiction | 187 | 221 | 18% |

Grand Total | 1,51,162 | 1,71,433 | 13% |

Analysis

- High Performers: States like Punjab, Haryana, Delhi, Assam, and Bihar have recorded significant growth, reflecting strong economic activity.

- Declining States: Jammu and Kashmir, Sikkim, Arunachal Pradesh, and a few others have shown a decline in GST collections, possibly due to local economic challenges or reduced trade activities.

|

Year |

GST |

Non-GST |

Total |

Growth% |

|

2017-18 |

500.00 |

785.46 |

1285.46 |

- |

|

2018-19 |

878.96 |

645.20 |

1524.16 |

18.57 |

|

2019-20 |

1011.24 |

584.63 |

1595.87 |

4.70 |

|

2020-21 |

994.76 |

742.90 |

1737.66 |

8.88 |

|

2021-22 |

1280.87 |

738.13 |

2019.00 |

16.19 |

Comments

Post a Comment